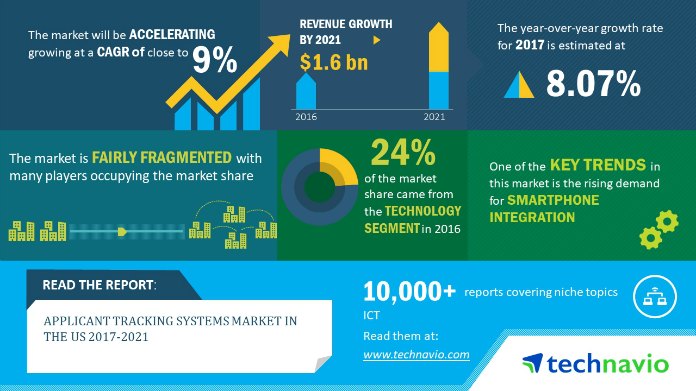

Relatively low prices and the integration of increasingly sophisticated analytical tools will drive growth of the U.S. market for applicant tracking systems to a steady CAGR of 9 percent by 2021, according to a report by research firm Technavio.

Vendors are offering low- and medium-priced systems that allow different types of users to deploy systems that better manage their databases of potential candidates in more detail and in ways that improve communications and automate the entire hiring process.

The report said major end users include organization in software and services, healthcare, food, retail, and financial services industries. Of these, the report argues that technology companies will be the primary users of advanced ATS systems. The reasons: They pay extraordinarily close attention to creating a positive candidate experience by using tools such as automatic responses at different stages of the hiring process and increasing their transparency.

Also driving the market’s growth is the integration of the ATS with analytical tools. Specifically, vendors are incorporating more analytics capabilities to facilitate the tracking and monitoring of applicant data in real-time.

As a result, employers can make more informed decisions about talent management and other HR processes, the company said. In addition, the growth of predictive analytics tools helps organizations make sure their hiring addresses necessary business requirements.

The market has become “intensely competitive and fragmented,” Technavio said. As a result, vendors have been pushed to develop innovative products that offer advanced capabilities to improve risk assessment and help businesses operate with more speed and efficiency. They’re also having to work harder to cut through the noise for customer attention–”tangible propositions” are critical, the researcher said. Also, many are consolidating their market share through acquisitions.

Not surprisingly, customers prefer cloud solutions to on-premise deployment because of the lower costs involved and their remote-access capabilities. “Key players implement various cloud software to support their expansion plans and to improve business intelligence reporting,” Technavio noted, indicating that ATS providers are integrating capabilities that go far beyond simple applicant tracking and process management to their products.

Technavio identified the market-leading vendors as, ApplicantStack, Greenhouse Software, Hyrell, iCIMS and Workable. Other vendors worth watching are BambooHR, Cornerstone OnDemand, ExactHire, IBM (Kenexa), Jobvite, Lumesse, Lever, Paycor, SAP SuccessFactors and Workday, it said.

In July, researcher MarketsandMarkets said the ATS market would grow from about $1.1 billion to $1.8 billion between 2017 and 2023, a compound annual growth rate of 8.3 percent. It predicted recruiters would increasingly rely on IoT and related technologies to automate their processes and enhance the candidate experience in a tight labor market.

Image: Technavio