BrightPlan launched its new Workforce Financial Wellness Gauge, an offering that “uses patented technology to surface valuable insights in real-time for employers and HR leaders,” by working with anonymized employee financial data.

The goal of the product is to help companies boost productivity and improve business metrics like employee turnover and engagement. With it, they can leverage the insights and work with BrightPlan to build targeted action plans to improve their workforce’s financial health.

According to BrightPlan, employee financial stress is at an all-time high, with 72% of employees reporting they are feeling the pain. In its 2022 Wellness Barometer Survey, the company found that financial stress leads to lost productivity, disengagement, turnover and delayed retirement among employees. In addition, the survey showed that 88% expect their employers to offer some kind of financial wellness tools and resources.

Wellness Scoring and Data

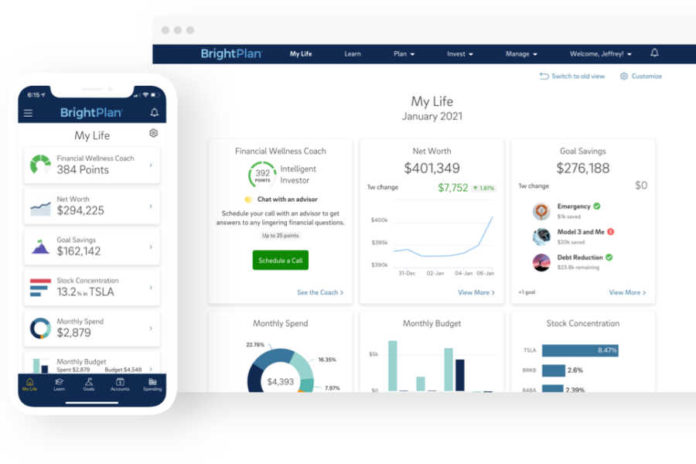

BrightPlan’s application assigns a score to employees as they engage and delivers personalized advice on aspects of personal finance such as budgeting and retirement planning. An employee’s score is based on three key measurements of their finances: commitment, engagement and empowerment. Then, the app aggregates and anonymizes the data for the employer.

Such an approach will provide employers with an understanding of the gaps in the financial wellbeing of their workforce. The product also guides companies on ways to resolve issues with tools including benefits optimization, DEI initiatives, education opportunities and retirement support.

In September 2022, BrightPlan unveiled its Equity Compensation Planner as part of its Total Financial Wellness solution. The capability gave employees digital tools and professional financial guidance to help them view and manage their employer-provided equity compensation, the company said. The Planner provides a transparent view and deeper understanding of an employee’s company-provided stock value, which may include restricted stock, an employee stock purchase plan and stock options.

Image: BrightPlan