Transcript

Mark:

Welcome to PeopleTech, the podcast of the HCM technology report. I’m Mark Feffer. Michael Fitzsimmons, the CEO of Crosschq, is my guest today. They just published their Q report, which offers insights that can be used to hire, retain, and develop your workforce. The latest report also begs some questions, like why are employers releasing workers with higher quality scores? How do Indeed and LinkedIn measure up against each other. And how valuable are self-assessments. We’ll talk about all of this and more on this edition of PeopleTech.

Hi Mike, welcome back. Crosschq recently published your Q report and it had some sort of surprising findings. Could you give me a high level view of the findings and what you make of them?

Michael:

Yeah, so a couple of things. One is just to orient your audience in terms of what our Q report is, and so Crosschq’s in the business of providing hiring intelligence for companies, helping them better understand all aspects of their hiring process. And so one of the things that we’ve focused on really heavily is this idea of connecting outcomes with hiring decisions. Not just did we get the butt in the seat quickly, but how did that butt in the seat ultimately end up performing? So the Q report is our sort of cut at sharing some of those insights to help better inform and educate about the things that we’re seeing in the market. So this is our actual second Q report that we have published, and we have another flash Q report coming out this week, which is pretty cool. And we dug into a number of different topics ranging from D&I and what’s happening with diverse hiring to what’s happening around quality of hire with folks that we’re letting go in our layoff process across the board. So there’s a number of cool things in there that we can dive into.

Mark:

Yeah. I mean, one thing that caught my eye in the report, it looks like employers are often laying off employees who actually have higher scores than the people they’re keeping. What’s going on there and what’s the background?

Michael:

One of the things that it’s tough in terms of we’ve all been through these processes and how we’re making decisions around workforce optimization. I think what we’ve found is that oftentimes companies are flying blind and ultimately these decisions are made with a fair amount of recency bias, frankly on behalf of whoever the manager is. Oftentimes what happens is we get a piece of paper pushed across the table that says, ‘Hey Mike, I need you to reduce your headcount by $500,000, so go find me six employees to make that up’, or whatever that number is. And subsequently, it becomes less of a data driven process and more of a subjective feel, and there’s a fair amount of recency bias we’ve found certainly with this concept of last in first out is a real thing. So those employees that we more recently hired were actually more likely to be let go in a workforce optimization exercise.

Mark:

It strikes me that could also make for some more tenuous or difficult conversations when you’re laying people off. Do you see that dynamic at all? Does it make the process a little more fraught than it used to be?

Michael:

Yeah, I think so. And if you actually think about how kind of absurd it is that we’re correlating, we’ve found that just there is not a correlation between a direct correlation between tenure and performance in that regard. If you think about that idea that, hey, we just hired this individual and we’re incredibly optimistic they’re going to be this great performer. And then just like that, right? We’ve made the decision that no, they no longer are. So anyway, it’s a thing and it’s just something we have to encourage all of our customers and broadly all of our companies to be cognizant of. And from our perspective, it really comes down to this idea, are we using data in order to inform these decisions? So are we actually looking at outcomes associated and using that kind of data? So whether it’s how they impact our culture or their performance and all the rest of it, that’s really a key part of the whole exercise here.

Mark:

Another thing that caught my eye was this discussion you had of candidate self-assessment and you found that those can actually be more accurate than assessments that an employer might do in traditional ways. And what’s your thought about that? It struck me as kind of interesting because you would think people would sort of try to blow themselves higher or make themselves bigger.

Michael:

Yeah. It does show you how nuanced it all is and how various roles and some of this feeds into, and this is what we’re talking about here, is a lot about soft skills. And one of the findings was that as an example, someone in an outward facing sort of sales oriented role, if they demonstrated high confidence bordering on arrogance during the assessment process, it actually turned out to be a good predictor of future success. So there was one of those things that don’t misinterpret that and look at that as a negative, whereas in other roles in the organization that might be, you might find a higher correlation or a lower correlation success based upon that. And if you’re in an engineering role or project management role where the focus is more around collaboration and things of that nature, you actually might want someone who’s got a little bit more self-awareness and a little bit less arrogance in that regard. So there’s very interesting stuff, and I think it just points to this idea that different roles demand different characteristics of our employees and of our talent.

Mark:

Do you find that hiring managers understand that kind of subtlety or do they have to be educated about it or are they just innately making good decisions?

Michael:

I think they have to be educated about it. It’s funny that you bring that up. We’re doing a tremendous amount of work now around skills and competencies specifically. And I know there’s a lot of talk in the market about this, but the reality is no matter how much hard work we do to help educate our hiring managers that the skills and competencies that might lead to a top performer in your organization may be different from what you think they are. Getting the hiring manager to build that muscle and trust it is a challenging thing. At the end of the day, so often it comes down to their gut instinct, and subsequently we all suffer the consequences of that. So I think it is a challenge. It’s a great question, and that’s part… For the whole industry to move forward, we have to get the full hiring teams in alignment with this idea of how do we kind of use data more effectively to make our decisions.

Mark:

Skills has become such a big topic over the last year or 18 months, and I’m wondering, do you find there are some ways that are better than others to evaluate a candidate skills or current employee skills for that matter?

Michael:

You have to chunk this up into at what point in the talent lifecycle you’re looking to make that evaluation. And so certainly post hire, it is easier to do. It is easier to better assess that individual based upon their willingness frankly, to participate in the process in order to gather the appropriate data to do that evaluation. But I think that pre-hire a complicated riddle, and it’s this idea of, hey, are there verified skills? Do you actually trust that the skills that they claim on their LinkedIn profile, on their resume are actual skills? How do we actually evaluate for those skills in the assessment process? How do we evaluate for those skills and competencies in the interview process? And frankly, are we even looking for the right skills and competencies? Where we have really pushed hard, and I come back to this idea that Crosschq uses outcomes, outcomes, outcomes in order to inform our talent decisions is unless you understand the correlation of what you think are the right skills and competencies to a predicted outcome from a performance perspective, it’s all for naught anyway.

And so what we have found so often is that companies may go hire some third party firm to come in and do an audit and tell them, ‘Hey, this is what your top performers look like. Go find more of those performers’. But those models quickly become stale and the ability for the entire talent ecosystem within the company to actually source for that talent, assess against that talent, interview for that talent, develop against that talent, against those skills and competencies, it’s a complicated riddle. So there is a lot of break points along the way right now, and I think we’re hopefully doing our part to help connect a lot of them, but it is a challenging riddle for sure.

Mark:

Well, it seems like if you’ve got a bunch of discreet skills and you’ve got a bunch of talent acquisition people out there trying to find the right candidates, that’s not a small job. I mean the need for skills will evolve and some skills are harder than others. And how do you face that kind of challenge?

Michael:

Well, I think this is where, to be be honest, where machine learning and data and all the exciting stuff with generative AI and whatnot is so helpful. It really truly is. When you think about the ontologies that have been created, the sort of public ontologies all the way down to the various providers that have their own proprietary skills ontologies where they’ve made some assumptions about here’s the skills and competencies for these jobs that are required. The reality in practice is those things evolve. They’re different based upon what the company is, they’re different based upon the time and place for the company. What’s the state of the market for that company? There’s just so much nuance to it. And I think that’s one of the challenges here is this has to be company specific. It has to be time specific. They have to be learning over time.

There’s something as simple as, I’ll give you a very discreet, simple example. If you’re thinking about a sales hire and you’re hiring for a salesperson that’s maybe in a SMB sales role, well your anticipated time to productivity or ramp time for that individual is very different for a sales hire that you’re hiring to sell into the federal government, just as an example, which will have a multi-year sales cycle. And so the skills and competencies associated with that sales role are very different than the skills and competencies associated with an outbound SMB sales role as an example. So I think there just is so much nuance to it that you have to actually have a system that is learning as it goes and that is actually connected with outcomes. I really think that’s the only way you can win here. But once you do it, you unlock some incredible power, you do increase your odds. And that’s the game here is if we can just move the dial by a couple percentage points, we can have a material impact on our outcomes.

Mark:

I wanted to change tracks a little bit because I was really interested in your discussion about Indeed compared to LinkedIn and the quality I guess, of their postings or results. And I wondered if first could you tell me the background of that question why you decided to look at those numbers. And why don’t I start there and then I’ve got to follow up?

Michael:

One of the things is, and we had two sections in this Q report about source of hire, and a lot of our customers have been pushing really, really hard on this specific subject and really understanding quality of hire by source. And this might seem so simplistic, but most companies don’t have a good ROI metric based upon what is their largest spend in talent acquisition, which is sourcing. They oftentimes look at their cost per hire, but they don’t take it all the way through to the outcome side to fully understand what the ROI associated with that hire. And so as part of that exercise, what was just fascinating to us, especially in the knowledge worker sector, the traditional bias has been that frankly LinkedIn is a significantly better source of hire than Indeed is for knowledge workers. That’s sort of the bias within the industry. And you see that based upon the spend that companies are deploying on LinkedIn for knowledge workers than they’re spending on Indeed.

And that’s the thing that popped for us. Like, oh my gosh, that’s a myth busted. You can find just as high quality talent for your knowledge roles on Indeed as you can potentially on LinkedIn. And I think that was the inspiration for it, just kind of jumped off the page for us and frankly surprised us, surprised a lot of our customers who have just historically thought of Indeed as more of a place to go get high volume labor than as a place to go get really sort of knowledge workers and that sort of thing. So that’s why it jumped off for us and we thought it was worth publishing and including in the report. And I will say we saw plenty of other data in here that showed in different pockets of higher types where companies were just ROI negative on their spend on some of these platforms. It was amazing.

Where you’re saying, Hey, we have one platform, I won’t mention who it is, and one client has spent $11 million on this specific job board only to find out that they had 187% turnover on those hires, that 75% of those hires didn’t make it three weeks, and that when you actually did the math, they were upside down on that investment. And so it was just a fascinating… What we want to try to do is empower our customers and our clients to change the narrative, which with their suppliers and their vendors when they can go back to the table and say, ‘Hey, I spent $11 million with you, but guess what? At the end of the day, if I look at that from a loaded cost per hire of the people that actually turned out to be successful. I’m running four times what I thought I was running’. So I think that whole conversation has to change. I don’t think it can change until you have outcomes associated with your data and you can kind of better measure it, but that’s where it came from.

Mark:

And the difference between the two and your scoring was only about a point. So I guess the surprise was that Indeed was even up there, not to mention-

Michael:

Exactly. Yeah, 100%. Yeah, I’m with you. The materiality of the Delta is not that substantial, but it is just the fact that they’re in the same conversation and that was the thing that I think was eye-opening for us and for our customers. Like, oh gosh, okay, maybe I should do some additional testing here and put some more dollars towards Indeed to fill these fill valuable roles.

Mark:

Changing tracks again. Your discussion of diversity and what’s going on with DEI was interesting. You showed that diversity hiring decreased about 11%, and I was reading that just about the time that the Supreme Court overturned affirmative action for college and discussion started to bubble up about what might happen to similar programs in the business world. So is that diversity hiring number an indication of a bad situation getting worse or do you have any thoughts about what it might mean?

Michael:

I have lots of thoughts and it’s a hard one. The bad situation getting worse is a tough one because I think also there was such a big push over the last, in ’21, ’22 on this topic that part of this might be that supply was exhausted in some instances and subsequently that’s part of the discussion and that that’s a piece where we have to go a layer deeper on that to fully understand this at a regional level and that’s sort of a thing. But the piece that was concerning for me was the uptick of terminations of diverse hires. I mean, that was the other piece of this, which was, gosh, we’re hiring less diverse talent into our companies. We’re also letting go of more diverse talent in our companies. I think that we saw a 9% increase in diverse talent terminations versus the prior 12 months.

So that was also a head scratcher in terms of the compound effect here. And understanding how those two things are correlated is a complicated riddle. But I do think that the number of D&I leaders that I talk to that are saying the same thing, that despite our best efforts we’re not convinced we’ve made the progress that we hoped we had made. Certainly at a systemic level, I think that’s a real thing. And I think that’s what our data is telling us. The why on that, the why we haven’t made the progress, I think goes back to a more nuanced question around where are these pools of talent? I think our companies are trying really hard. I really do believe that to be true. I think our companies are trying really hard, but I also think that the data says that we’re not making the progress that we hoped we would be making.

Mark:

And when you talk to these people, do they sense that things are going to get better, get worse, or just stay the same for a while?

Michael:

Yeah, it is. There’s a malaise for sure, and I wish I had a more optimistic view and I wish I had a catalyst frankly, for another wave of energy into the topic. I think that we’ve unfortunately seen D&I budgets get cut in our organizations. We’ve seen a number of D&I leaders that have been part of these kind of layoffs that have gone down. There’s just a lot of that energy. I’m concerned that we will take our foot off the gas. I think that’s a real thing, and I think it’s incumbent frankly upon all of us to keep the topic top of mind and to keep publishing data on the topic. That’s from Crosschqs perspective and our role in this. We think as long as we keep on it and we keep companies accountable and we keep publishing their data so they have access to it and they understand the nuance of what’s happening. Just look at these two insights if you were running an organization and I came to you and said, ‘Hey, you’re hiring 11% less diverse talent, and by the way, you’re had a 9% increase in terminations of the diverse talent that you have hired’. Give you those two data points. Hopefully you can take action against that and at least be a little bit more aware of exactly what’s happening in your company to try and take that on.

Mark:

Just one more question, and actually it’s about Crosschq. A couple of months ago you bulked up Crosschq insights and Crosschq voice products. How’s the reaction been and are you happy with how it’s playing out?

Michael:

And to take a step back as to why we did that, one of the things that we realized is that we had built an incredible muscle in terms of getting direct insights from talent and from leaders and that sort of thing. And we really hadn’t done a good job of breaking that out and productizing that. And I think broadly, we look at the employee listening market as a still, I think we’re in the early innings of really having the solutions of tomorrow in the market as it relates to employee listening. So we thought it was the right time to do that, and Crosschq voice, both with our combination of our ability to do timely surveys, multi-channel surveys, as well as all of our different integration partners with the slacks of the world and those types of things, and the workdays of the world and our ability to listen to this talent data.

We just thought it was time to sort of clarify that that solution set was available and could solve a whole bunch of more business problems. So it’s been really helpful for us from that perspective. The market reaction has been positive, and it’s been a good point of clarification for us in the market, so companies can think about us the right way. Our insights suite of products, we made an acquisition last year of a company called TalentWall, really focused on talent acquisition, recruiting, benchmarking, and insights and things of that nature. We also have our quality of hire, analytics, and insights products, and we just also thought it was important to be able to separate those two things for our customers. So at the end of the day most of our customers are buying both of the product sets, but there are some that are coming to us just because they need better listening, and there are some that are coming to us because they need better analytics and insights, and we’re happy to support them.

Mark:

Mike, it’s always great to talk to you, and I appreciate your time today. Thanks for stopping by.

Michael:

Yeah, I appreciate it. I appreciate you taking the time and have an interest in Crosschq.

Mark:

Today I’ve been talking with Mike Fitzsimmons, the CEO of Crosschq and this has been PeopleTech, the podcast of the HCM Technology Report. We’re a publication of Recruiting Daily. We’re also a part of Evergreen Podcasts. To see all of their programs, visit www.evergreenpodcast.com. And to keep up with HR technology, visit the HCM technology report every day. We’re the most trusted source of news in the HR tech industry. Find us at www.hcmtechnologyreport.com. I’m Mark Feffer.

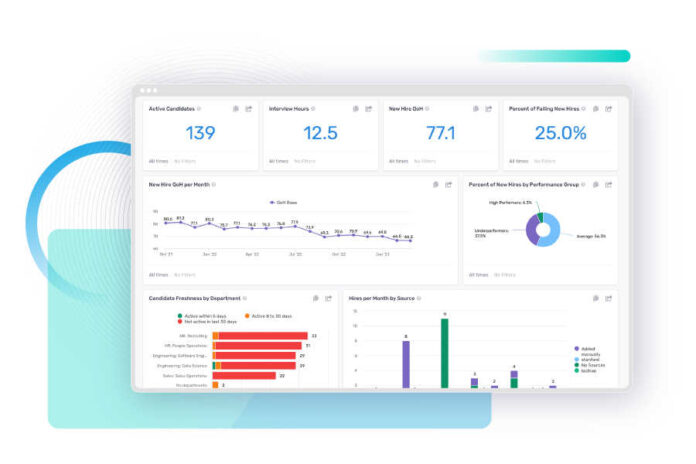

Image: Crosschq