Transcript

Mark:

Welcome to PeopleTech, the podcast of the HCM Technology Report. I’m Mark Feffer. My guest today is Jeanniey Walden, the Global Chief Innovation and Marketing Officer at DailyPay. We’re going to talk about some of the company’s new products, how COVID-19 impacted the business, their vision for the future, and the role of integrations all on this edition of PeopleTech. Hey, Jeanniey. Welcome back. You’ve got some product announcements coming up. Can you give me a preview, tell me about them?

Jeanniey:

Absolutely. Absolutely. Well, I think one of the most exciting things is, as we continue to expand our portfolio, we’ve realized that we’re not announcing new products necessarily as much as creating a holistic solution around changing the way the financial system works, which is very cool. Most recently, we are announcing the launch of Friday, our general purpose re-loadable card, which can be used by anybody who works at a company that offers DailyPay, and soon in the future, anybody, even if they don’t work at a company that offers DailyPay.

We’re excited about this because it extends the ability for un-banked or under-banked employees to be able to have a physical or digital credit card that now gives them much more capability in our increasingly growing digital-first world. Recently, I was on an airplane. I was on United. I think everyone’s the same these days. If you want to buy something on the plane, it needs to be through a credit card that you’ve already put into the app. If you don’t have a credit card, you’re going to be really hungry on that flight. Friday could feed thousands of hungry flyers, and nobody wants an angry flyer.

Mark:

No, no. What’s the thinking behind this? Is there a particular theme in the development work you’re doing now and these new products?

Jeanniey:

I mean, it really follows our mission of reinventing these invisible rules of money and changing, eliminating barriers and obstacles that both employers and employees have seen when it comes to fiscal confidence and fiscal responsibility. Specifically with Friday, what we realized were … I mean, it’s great, with DailyPay, to be able to see your DailyPay balance and understand how much money you have. But if you didn’t have a card to put it on, then it was very difficult to use those funds. If you happened to be driving home from work and needed to hop into a store or a place where you needed to use a credit card to do a transaction, or a digital card, this gave people that capability. It made it simple for them to be more portable.

Mark:

Let me step back a bit. I want to ask you about the industry. What’s going on out there? I do seem to see more and more companies wading into the whole DailyPay area. What do you think is behind that, and does anything out there particularly excite you?

Jeanniey:

Well, I’ll go back to those overnight successes that we all hear about that traditionally take about seven years to take off. I think DailyPay has been around about seven years. It’s exciting to see that the industry, in general, is accepting the fact that the way that people get paid needs to change, and that it’s not a fad or a trend anymore, as much as it is a way of life. It’s very exciting to see that industry-wide acceptance. Now, along with that, we are starting to see, I think, from DailyPay’s perspective, a lot of people trying to ride the coattails of the successes that DailyPay has made in the on-demand pay world, or even the on-demand pay world in general, where neobanks are trying to market, access to Spot Me, or other programs where you get paid two days early, as on-demand pay when realistically, it’s not the same.

If you got paid every other Friday and now you could get the money every other Wednesday, that’s not moving to on-demand pay. It’s moving your pay day two days earlier. I think that as we see all the enthusiasm around this, we’re also seeing the lines getting blurred between the way that companies are marketing similar services, but not necessarily ones that follow the same constructs as we do at DailyPay. But the wide acceptance really means that it’s just a matter of time before everybody starts to appreciate and understand the best ways to run programs like this, internally inside organizations, and then externally with employees.

Mark:

I can’t resist asking, was there an impact on the business from COVID-19?

Jeanniey:

Impact from COVID-19, I think, first was on the business side. It was more of a realization that employers needed to step up the way that they were focused on the financial wellness of their employees. Prior to COVID-19, when we would talk about DailyPay with companies, there was a concern that, “Oh, if I gave my employees DailyPay, they’re going to take all their money out of the bank as soon as they see it in their DailyPay account, and they’re going to spend it foolishly, and then they’re not going to have any money left.” We used to laugh because we say, “Do you run to your ATM every single day when you look at your balance, it has money in it, and take all the money out and spend it foolishly? No.” You’re probably not going to do that with an on-demand pay solution, but the money’s there helping to avoid late fees and overdraft fees.

I think what happened with COVID-19, as we went into a pandemic, many people lost their jobs. Many people had to take pay cuts. For those that lost their jobs, they fought against delayed unemployment benefits. The people that were working, they needed help for their entire household and not just themselves. That gave employers a different appreciation for what physical access really looked like. For us, it was a great experience to help businesses understand how to maintain and engage their employees differently and better to help them and show up as a partner and not just an employer. Then, of course, we saw a number of organizations whose businesses just went crazy during COVID. They were in a hiring rush and offering DailyPay is definitely a differentiator. Do you want to make $20 an hour at this company and have access to it immediately, or do you want to make $20 somewhere else and have to wait two weeks for it? Probably three weeks, because you always start the last week, when you just missed payroll.

It became a way for them to promote and look for great talent and also retain great talent, which was great, which then drove the post-COVID cycle. This is interesting, because coming out of COVID, we saw a lot of industries, especially in the retail segment, that had increased salary significantly up to $20, $22 an hour, so that they could recruit talent to get them enough staff to deliver boxes and man the retail stores. Well, the businesses that stayed shut down during COVID, or were minimally working, they didn’t raise their salaries because they didn’t really need staff. When COVID started to end and break, what we started to see was a very different imbalance. You could work inside a little shopping mall, you could go work at your company making $11 an hour because they didn’t really increase salaries during COVID, or you could go work next door at the retailer and make $20 an hour. Which one are you going to do?

That, I think, started … That is one of the impacts that created … A lot of what we see in the Great Resignation was an imbalance in funds. That drove a lot of companies to catch up. One of the ways that they were able to catch up outside of increasing wages were also to offer DailyPay. I think, all in all, we continue to see DailyPay playing a key role in helping to balance workers’ lives. Now in this recessionary environment that we’re in, before you ask me that question, I’ll answer it, usage is absolutely going up around stable goods. People are using DailyPay even more than they were before for rent, just staples around the house, paying electric bills, just keeping up with the increased prices. We saw a huge increase in usage for gas during the spike of all the gas prices everywhere. They’re still high, but they’re starting to come down a little bit. We’re just continuing to follow the market trends and help people the best that we can.

Mark:

Now, I’ve talked with you a lot, usually about DailyPay and the business. I was looking at your website the other day and it occurred to me, you’ve got about 14 integration partners, I think. It made me curious, how does integration play into your strategy?

Jeanniey:

Well, I don’t know if there’s an amazing answer for this, other than it’s a channel partner strategy. Individually, as an emerging hyper-growth startup, we’re hiring as fast as we can on the sales front, but there’s many more opportunities when you connect into the ecosystem of an ADP or a PNC, where they’ve already built established relationships with thousands of companies who are also in need of this service for their employees. It is very much a lot of white space out there. We’re not in a market yet where our next client is going to come from somebody leaving another on-demand pay provider. I mean, there’s still enough opportunities out there in the US alone that, I think, anybody that’s offering an on-demand pay solution could probably triple the size of their accounts this year and we still would never come in contact with each other. It’s still early stages for growth. Our integration partners are seeing the need. They’re getting those requests. Their clients turn to them for advice. They’re making sure that they’re aligned with the best solutions out there and we’re thrilled to work alongside of all of them.

Mark:

Now, you got a new CEO in June, I believe.

Jeanniey:

Yes.

Mark:

New CEOs almost always come with visions.

Jeanniey:

Yes.

Mark:

I’m wondering, can you talk about his?

Jeanniey:

His vision is big. I’m not sure how much I can disclose of his vision, but I can tell you that he’s come in and loves the mission that we have. When we’re looking at creating a new financial system that works for everyone by eliminating the invisible rules of money, which is the whole mission statement, there’s a lot more than just offering on-demand pay services, whether it’s our pay, our save features, off-cycle, behind the business. There’s entire population sets out there that it will take us a very long time to serve if we continue just down a certain path. We do have big plans for expansion in some very interesting ways, new products, new areas, new opportunities.

Mark:

How about your vision? I mean, I don’t want to get into dueling visions, especially with the CEO, but are there any-

Jeanniey:

My vision as a CMO, it’s fascinating, because oftentimes I think back to other jobs that I’ve had and say, “Well, this worked really well here. Why didn’t I do that at this job?” Or, “This worked really well at this job, should I be doing that here?” One of the things that I’ve realized at DailyPay is in an emerging market … It’s not like we’re Coca-Cola. You can’t just come out and say, “Hey, we’re a new flavor of Coke, you all love Coke, you’re going to love this pumpkin Coke better,” and the branding comes out of something that people are familiar with. DailyPay is truly creating a new solution that a lot of working Americans still haven’t even heard of as the market continues to grow. All they know are payday loans. They don’t even know there’s alternatives out there.

My vision continues to be to create a very strong brand that supports and helps people, and builds awareness that there all are alternatives out there to payday loans, and that there are other ways to engage with the money that you’re working so hard to earn that can allow you, or afford you, to live a more fulfilling life. I don’t think Kevin and my visions conflict at all. I think they’re very supportive of each other, but there’s still a lot of work to do around education. We joke around at DailyPay. Every once in a while, we’ll walk outside and ask 10 people if they’ve ever heard of DailyPay. Until seven of them say, “Absolutely” … They can say, “Absolutely, but I wouldn’t use it,” or, “absolutely, and I’ve used it in the past.” I don’t care what they say about it, but until there’s seven out of 10, I think we’ve got a long way to go for just awareness of on-demand pay in the mass market.

Mark:

Jeanniey, it’s always great to talk with you. I really, again, appreciate your time.

Jeanniey:

Thanks so much. You too, Mark.

Mark:

My guest today has been Jeanniey Walden, DailyPay’s Global Chief Innovation and Marketing Officer. This has been PeopleTech, the podcast of the HCM Technology Report. We’re a publication of recruiting daily. We’re also a part of evergreen podcasts. To see all of their programs, visit www.evergreenpodcasts.com. To keep up with HR technology, visit the HCM Technology Report every day. We’re the most trusted source of news in the HR tech industry. Find us at www.hcmtechnologyreport.com. I’m Mark Feffer.

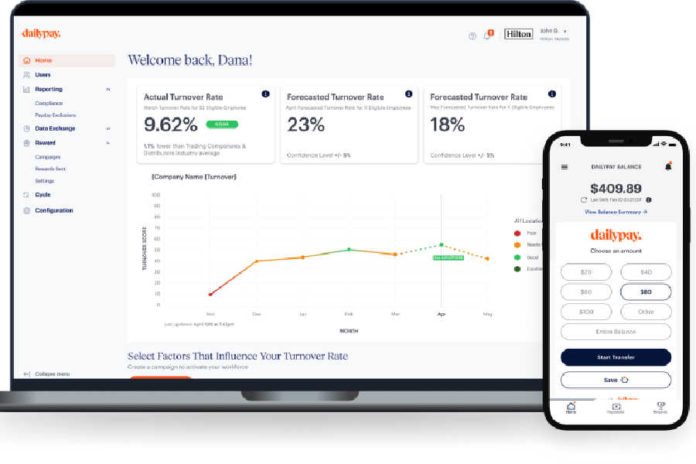

Image: DailyPay