ADP announced a new component in its cross-platform relationship with QuickBooks developer Intuit. As of today, QuickBooks Online users can connect their accounting data, in real time, with ADP’s RUN small business payroll software.

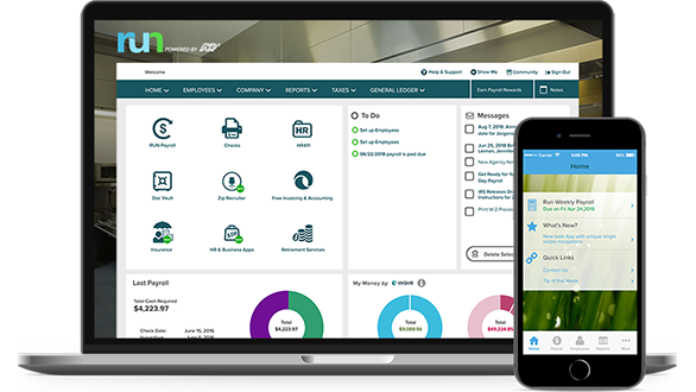

.@ADP, @Intuit's new integration strengthens the hand of accountants serving #SMBs, as well as streamline payroll. #HR #HRTech #Payroll @QuickBooks Share on XADP said the integration offers a “simplified, friendly design” and will streamline their payroll and accounting chores. Meanwhile, accountants who are QuickBooks ProAdvisors can access the functionality for their RUN clients through ADP’s client platform, Accountant Connect.

In addition, the integration provides a simpler and more accurate general ledger mapping experience, which ADP said will eliminate the need for offline customer service assistance in activating and manually setting up the connection. The need to manually generate general ledger files and download data for each pay period is also eliminated, ADP said.

For QuickBooks Desktop users, mapping and integration have been improved to simplify set-up.

Noting that accountants today spend more time acting as strategic business advisors to their clients, Joe DeSilva, ADP’s senior vice president of Small Business Services, said the integration “gives back much-needed time that accountants can use to re-invest in their broader advisory services.”

Ariege Misherghi, Intuit’s accounting leader, said the connection helps joint customers “be more efficient and save time so they can focus more on strategic business decisions that help them grow and prosper.”

Big Companies, Small Business Services

This isn’t the first step ADP’s taken with Intuit to move deeper into the microbusiness market and the accountants who support it. In November 2018, the company enhanced its General Ledger Interface mapping with QuickBooks. At the time ADP said that move, combined with enhancements to its Compensation Benchmarking, would let Accountant Connect users to “better position” to provide more comprehensive services to their clients. It also promised more GLI enhancements would come in early 2019, and here we are.

Accountants have taken note. “This is pretty exciting because you have a big player like ADP recognizing the need for small business,” said one CPA and business advisor.

ADP and Intuit dominate the market for SMB payroll and finance. Quickbooks controls the lion’s share of the micro-business financial software market, and small business owners continue to tell us that when it comes to payroll, the first solutions that come to their minds are ADP, Ceridian, Paychex and Intuit Payroll. Newer entrants, like Gusto, are changing that calculus, but slowly. No CPA, it seems, ever got fired for recommending ADP.

We continue to believe, as we did last year, the ADP has the most to gain from its partnership with Intuit. More companies—such as Gusto, Square, PaySmart and CBIZ—are pursuing SMB customers, and while ADP has broad name recognition but still stirs grumbling about a lack of customer service and sometimes clunky tools. A close with relationship with Intuit can only bring ADP closer to small-business prospects, many of whom express an innate trust in QuickBooks and its other products.

Sign up for our newsletter here.

Updated May 9, 2019, with comments from accountant.

Image: ADP