Transcript

Mark:

Welcome to PeopleTech, the podcast of the HCM Technology Report. I’m Mark Feffer.

My guest today is Taylor Liggett, the Head of Identity Services at Sterling. We’re going to talk about the technology behind background checks, what candidates want from the process and where the industry’s going, all on this edition of PeopleTech. Hello Taylor. Welcome. So tell me about Sterling.

Taylor:

Yeah, so Sterling is one of the world’s largest background screening and identity services companies. So we support about 50,000 customers or so around the world. We conduct just about a hundred million annual checks each year and we’ve been in business for a number of decades. So we are an established player in the screening identity space, but have had a big recent focus, let’s say the last several years really with the emerging identity space that’s been of a particular focus for us lately.

Mark:

Yeah, I’ve got to imagine that with all the things going on because of COVID and the recession, we had the great resignation, people then going getting new jobs, it’s got to be an interesting time to be following identities and working on that. Can you tell me about it?

Taylor:

Yeah, I mean you’re spot on. It couldn’t be a more interesting time. COVID served as kind of a giant accelerator for a lot of underlying trends that were already in place or that were already starting to shape up. So let me expand on that a little bit. There were two sort of large kind of macro things that happened in the wake of COVID. One was of course the shift to remote work. So many, many companies in the U.S. and broadly moved their workforces either wholly or in part to be remote. So a whole bunch of new things came with that.

Secondly, there were significant, more so than we’ve ever seen in the history of the United States, at least, significant fraud related to identity verification or the lack of identity verification, identity fraud is the better way to say it. So if you think of things like unemployment benefits and government PPE loans and so on, they were huge targets for fraud and those centered around identity theft and misrepresentation and stolen PII, things like that. And so those two things, one of which increase the awareness of employers and the understanding of what needs to be done in a remote environment and the other one that just broadly increased awareness to the prevalence of identity theft and the impact that it can have on society.

Mark:

Well, what’s your view of the labor market today, first of all, and then how’s it reacting to all this?

Taylor:

So there’s a couple things that are happening. What we’ve seen are employers, by and large, the labor market by and large, is certainly realizing that they’re taking stock of a couple things. One is what is happening in existing processes? What are we doing as an organization to verify the identity of people that we’re hiring, to know who they are and to guard ourselves against potential threats that could come from that. And secondly, I think it’s reevaluating a lot of process. I’ll give you an example. If you think of I-9 verification that’s happened, I think it was created in 1985, hasn’t changed a lot. The wake of COVID, the move for remote work challenged that quite a bit because there’s one of the central requirements of I-9 is that you have to do things in person. And so DHS use it, they’ve sort of relaxed that guidance.

They’ve said there’s exceptions. You can do things over video, like a Zoom type thing. It’s caused the focus to modernize that entire process. So I think the labor market and employers are really paying close attention to all of these things. Also evaluating the types of tools and technology that’s available today to streamline these processes. And then in many cases becoming acutely aware of just the extent of what some people are doing. So we’ve seen an increase in one person interviewing for a job and another person showing up for a job. We’ve seen an increase in people using stolen information or falsified information to trick background checks and everything sort of involved in that. So I think employers are becoming aware of what’s happening and also how to guard against them and then also how to adjust processes to the different times that we’re in.

Mark:

Do employees or job candidates give this any kind of thought?

Taylor:

Yeah, I think we’re probably relatively early on in that. I mean, yes, I think they do, but what we’re seeing is we’re seeing a sort of transition from what I would call the analog days of identity where you just show an ID or that type of thing to more of a digital identity verification. If you think about just individuals in general, whether they’re applying for a job or whether they’re going to stay at Airbnb or they’re opening up a bank account, people are becoming more and more familiar of identity verification processes you have to go through. And I think what the big thing that’s exciting me from the consumer or individual or job applicant standpoint is that there’s now the promise of reusable digital identity. Meaning you can go through one of these processes one time, kind of claim your digital identity and then be able to reuse that in different instances.

That is really promising and that is something that I think more, and more people are becoming aware of, whether it’s through the lens of ID.me, Sterling’s close partner that does this and has this in place for a lot of the U.S. government and many sort of organizations and through Sterling’s workflow or if you take another kind of consumer and application like a CLEAR where people go through airports and by virtue of giving their biometrics one time, they can streamline their way through airport lines. So I think consumers think individuals job applicants are becoming more aware of this.

Mark:

I mean it seems like there’s a lot of technology involved in all this today. You’re dealing with a global workforce, so a bigger universe of people and they’re moving around more and they have different kinds of identification. What’s the technical challenge like?

Taylor:

Yeah, I mean there’s a couple things. So one of them I guess would be global in nature. So if you take a step back and just think through how do tools work that verify someone’s identity, I mean there’s a couple different approaches you can take. I think the default standard, or I guess what sort of become the default standard is if you consider document validation, I don’t know if you’ve ever done this, but you can take a photo of a document, government issued ID, driver’s license, passport, what have you, and there’s technology that goes into that, machine learning, AI, et cetera, that can essentially authenticate that that document is a real document and then you can take a photo of someone and do face matching to compare it to that document, make sure the person that’s presenting it is actually the person on that document.

If there’s technology like that and that relies on understanding document templates. So for that to work, that machine needs to know what a Colorado’s driver’s license looks exactly like, where the hologram is, et cetera. And then you can just extrapolate that to the many different types of documents that exist around the world. So that’s one of the things from a technology standpoint, based on one of the identity verification techniques that comes into this. Other methods include things like mobile phone-based verification where perhaps a text message is sent to your phone, you kind of click on that. And then by checking the SIM card and the IMEI number with your phone, with telecom records, maybe comparing some PII to those telecom records, maybe doing geolocation and make sure you’re in the spot you should be in. That’s another example of the technology that that’s involved in this. So those things, I think they’re continuing to evolve but have reached a point of working very effectively and it differs depending on where you’re at in the world but that’s a little bit about the technology side of things.

Mark:

How do you see the business growing in the next X number of years? And I mean, do you see it becoming less expensive in some cases? So more accessible to small and medium businesses, focusing more on the enterprise or all of them? What’s the course?

Taylor:

Yeah, it’s a great question. So there’s a couple things I’d say here. I mean, one is the application of identity verification and doing it in this sort of digital mobile accessible way is not new. It’s used very prevalently throughout financial services. It’s used very prevalently throughout a lot of gig companies. They were one of the first adopters because if you consider their model, they’re dealing with a workforce that’s dispersed and not coming into offices and so on. It is relatively new to employers, whether it’s enterprise or small, medium business. When Sterling released our solution with ID.me this year, it was one of the first at scale solutions, at least within the U.S. This differs sort of depending certain regions. If you take UK, Canada, Australia have some requirements in place on this, but it is relatively speaking new to employers. One of the things we’ve been focused on and that I think others will be as well is making it not cost prohibitive in any way.

So a relatively nominal type of transactional fee if it can be added to any type of background check so that this can become universally sort of used. Our view is that we believe that this should really start serving as the first step prior to a background check, prior to the pre-employment process. It’s relatively easy to do, takes anywhere typically from 30 to 90 seconds for someone to complete this. Just to give you an example of how quick it can be, relatively inexpensive, usually we’re talking a couple dollars or something like that.

And so I believe, to answer your question where we’re heading is just scaling this across all types of businesses and helping employers understand what does and doesn’t happen during the background check process. Honestly, Mark, one of the biggest things we’ve found out is there’s tremendous confusion that employers have out there about what is and isn’t happening today. Many, as far as some of our surveys and research has shown is many as three quarters of HR practitioners either mistakenly believe identity verification is just happening by default in the background check or don’t know sort of where it’s happening during the pre-employment process. So that’s another piece of this is just the education discussions like this to help employers understand what is and isn’t happening.

Mark:

Now we’re recording this just before Thanksgiving of 2022 and it’s pretty much a law that I ask you about what you think is going to happen in 2023. So what are your predictions? What do you see happening next year for the business?

Taylor:

Yeah, so I think there’s three things that happen through the lens of what we’ve been discussing. So the first is that I believe that the application of identity verification and digital identity throughout the employment process makes a serious move in that direction. In other words, employers start to really understand the need for this, that it’s not happening and start to implement these tools. The second thing that I see is that consumers, individuals, job applicants start becoming more educated themselves on this and start leaning into reusable digital identity. That is to say trusted systems where they verify their identity one time and then can reuse that with applications for government, business, et cetera. And with that comes a whole bunch of what I call kind of privacy preserving principles. In other words, people being in control of their own information. So I’ve verified my information, I’m now choosing to share it with this employer or this education institution or government agency, and here’s exactly what I’m sharing with them.

I think that in 23, that becomes a real reality for most Americans and many people outside of the U.S. And the third thing I think that really starts to happen is this starts to evolve beyond just reusable digital identity to other verified attributes about someone. So if you consider just how the background check process works as a framing for this example, we often verify immutable data, for example, like a college degree or work history, things that don’t change, but in current state, most of the time those things are re-verified every time someone changes the job or if someone starts working as an Uber driver, they go through all kinds of checks and then they go and work as a Lyft driver, they have to do all that same stuff again. I think we start to see serious movement in a direction where digital wallets and the like can enable people to go through processes like that one time and then we use it in another time.

Mark:

Taylor, thanks very much for taking the time today. It was great to meet you and great to talk to you.

Taylor:

You’re very welcome. Thanks for your time, Mark.

Mark:

My guest today has been Taylor Liggett, the Head of Identity Services at Sterling. And this has been PeopleTech, the podcast of the HCM Technology Report. We’re a publication of RecruitingDaily. We’re also a part of Evergreen Podcasts. To see all of their programs, visit www.evergreenpodcasts.com. And to keep up with HR technology, visit the HCM Technology Report every day. We’re the most trusted source of news in the HR tech industry. Find us at www.hcmtechnologyreport.com. I’m Mark Feffer.

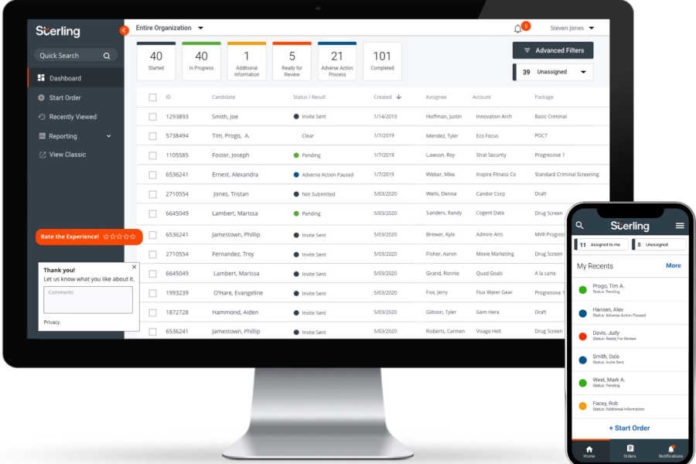

Image: Sterling