Infor has received a $1.5 billion infusion, which the company called “an important milestone” as it mulls the possibility of an IPO later this year or in 2020.

The investment, from shareholders Koch Equity Development and Golden Gate Capital, builds on the more than $2 billion KED put into Infor in early 2017. “All of our 17,300 employees are excited about this milestone as we prepare for the next stage of growth,” Infor CEO Charles Phillips told Barron’s.

Says Infor: Its recent $1.5B investment is 'a milestone' on its way to an #IPO. #HRTech #Funding Share on XWell, maybe. Many of those employees undoubtedly know that IPOs tend to change the dynamics of a company and how it operates, with greater emphasis given to quarterly earnings than long-term R&D.

“It’s the first time we’ve publicly discussed an IPO,” observed Phillips, a former president of Oracle. Among other things, the IPO’s timing “will depend on how markets react to [IPOs of] Uber and Lyft, valuations, the economic outlook. We need to hit the right window.”

Barron’s said Infor “has edged toward an IPO largely because of its business relationship with Koch Equity Development.” KED, with 120,000 employees, became a customer in 2012 and has expanded its use of Infor to manage human resources and manufacturing operations.

Infor’s Billions on Development

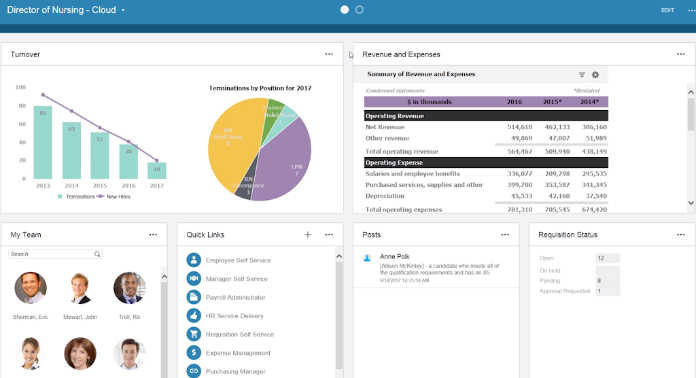

Infor reports spending about $2.5 billion in product design and development over the last five years, and calls its CloudSuite product line “the only fully multi-tenant ERP suite spanning front and back office applications, as well as logistics with global support,” meaning languages, currencies and localizations.

The company earned over $3 billion in revenue during fiscal 2018 and was the first solutions provider to move mission-critical ERP suites to public clouds for entire industries. It reports having about 9,500 customers in 110 countries. In addition to HR, its applications address needs in finance, manufacturing, supply chain and customer support. Seventy percent of its software license revenue comes from cloud applications, the company said.

Infor has been moving to expand its activity in several industries recently, including healthcare, manufacturing, retail and hospitality. The company calls its ability to tailor CloudSuite to the needs of specific industries “fundamental” to its strategy.

According to TechTarget, industry analysts expect the latest investment to strengthen the company’s product line. Ray Wang, a principal analyst at Constellation Research, told the website the investment represents “more money for expansion and investment in product and innovation.”

Others point out that there’s more to this investment than product-building. Earlier rounds were used to extend Infor’s “product capabilities and industry coverage,” said IDC Analyst Mickey North Rizza. “This investment will continue that but will also go into the capital restructuring in preparation for an IPO.”

Sign up for our newsletter here.

Image: Infor