Cornerstone OnDemand and Beamery are nearly finished creating an API integration that will allow their platforms to sync candidate and vacancy data. As a result, Cornerstone said, joint customers will be able to manage talent acquisition from sourcing to hire, as well as create personalized candidate experience.

The integration will help with talent rediscovery, as well. Cornerstone said its users will be able to re-engage past applicants as new roles arise. It will be available for all verticals in North America, Europe, the Middle East and Africa.

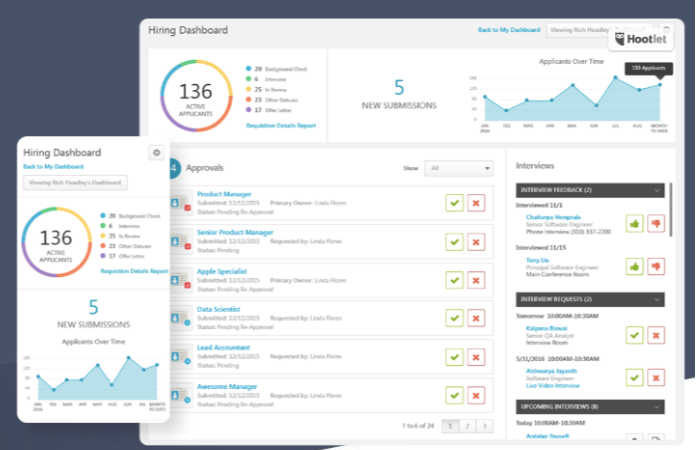

Joint customers of @CornerstoneInc & @BeameryHQ will soon be able to manage talent acquisition from sourcing to hire, create personalized candidate experience. #HR #HRTech #Recruiting Share on XCornerstone and Beamery position their partnership as delivering an end-to-end TA workflow. Beamery focuses on sourcing and candidate engagement while Cornerstone’s Recruiting module manages the entire application process.

Both companies have had busy years in terms of product development. In May, Cornerstone launched several products focused on internal communications and employee learning, all designed to increase engagement by nurturing learning-heavy cultures. The company also continued its efforts to win over SMBs by offering deals on its learning management system, PiiQ

Meanwhile, Beamery launched a “Behavioral Boolean” tool called Search Assist to allow customers to combine keywords, geographic and historical data with live behavioral information and candidate interactions into highly targeted search strings. At the time, Beamery said Search Assist was the first search tool take such an approach.

Beamery has also received a strategic investment from Workday Ventures and joined the Workday Software Partner Program.

CSOD Stock Price Hits High

Cornerstone OnDemand’s stock price has risen steadily this year. On July 9, it hit an all-time high of $60.95 before closing at $60.87.

Just a few days before, some Wall Street analysts expressed some hesitation about its price trajectory. One, Steve Auger of Seeking Alpha, worried about Cornerstone’s reliance on global services and content partners to help grow its business. Third-party agreements, he said, take “significant time” to negotiate and often aren’t exclusive, meaning partners can offer their technology or services to a vendor’s competitors. However, in today’s era of integrations it seems to use factoring in that scenario could be given for almost any company. (And see the above reference to Beamery’s relationship with Workday.)

To more closely manager its partners and ensure they’re properly trained on its products, Auger believes Cornerstone should spend more money on sales and marketing. However, he said, the company wants to economize rather than invest in expanding its sales force. He thinks that’s a mistake.

For 2019’s first quarter, Cornerstone OnDemand reported revenue $140.1 million, a 5.3 percent increase year-on-year. Subscription revenue was $131.3 million, a 16 percent increase, and operating income reached $1.2 million, compared to a loss of $8.8 million during the year-ago period.

Sign up for our newsletter here.

Image: Cornerstone OnDemand