Transcript

Mark: Welcome to PeopleTech, the podcast of the HCM Technology Report. I’m Mark Feffer.

Today my guest is Nico Simko, the founder and CEO of Clair. They provide pay-on-demand services for a range of companies, including small businesses, so he’s immersed in questions about the growing complexities of payroll, rising employee expectations, and how to build a business in today’s economy. We’re going to talk about all of that and more on this edition of PeopleTech.

Hi, Nico. Welcome. Tell me about Clair. What do you guys do?

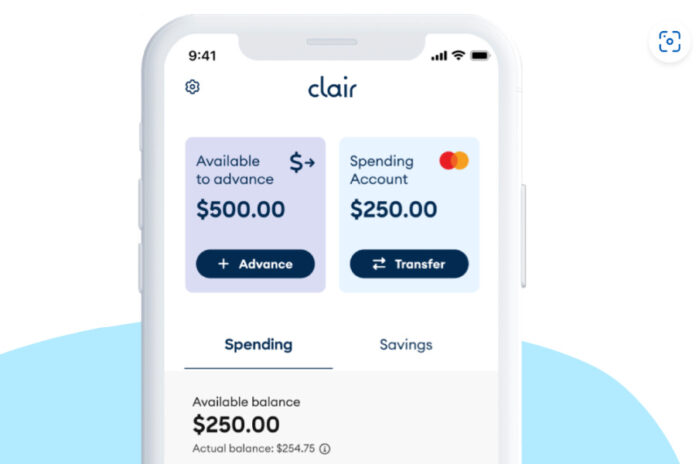

Nico: Yeah. So, Clair is a digital bank that embeds within payroll and workforce management companies. And what we do is we offer holistic banking services for America’s workforce that’s salaried, hourly, or even gig workers. And within that, we have a very specific feature which is differentiated from many other platforms, is the minute workers clock out of work, they see that up to 50% of their wages are available immediately, for free, and instantly in the app. That’s Clair, in a nutshell.

Mark: You said 50% of their wages are available right away. How do they get the other 50%?

Nico: Yeah. So, this is just the wage advance feature. We believe that many Americans, I was one of them, I was an hour worker throughout college a while ago now, basically should have the ability to cover some unexpected expenses with money they’ve earned but not yet received, and the ability also to budget for that new way of getting paid.

So, the way we do it is we have a risk-based algorithm to figure out how much are they actually going to get paid. Sometimes you have allocations and things that happen that decrease actually how much your net pay is. And so typically we do 50%. We can go up to 100% for certain of our partners, but typically it’s 50% of their expected net pay.

Mark: So, they get the remainder through the app or does it just go into their bank?

Nico: It just goes into their bank. So, Clair is the primary bank account for these user customers, and so the rest of the money they get as a paycheck on a regular pay cycle by their employer.

Mark: Okay. So, could you contrast your approach with, say, DailyPay’s or Paylocity’s?

Nico: Yeah, of course. So, DailyPay, PayActiv, other providers, I think they’ve done a great job going through mostly enterprise customers and convincing their HR managers to add a feature into their HR tech stack. The main differentiation there is they require that the repayment of the advances go through the payroll process. So, it depends. They have multiple products there. I’m not an expert in their products. But basically what they do is they go through repayment via the payroll process.

We do it very differently. We actually advance money to consumers and then they get paid their paycheck into the Clair bank. And so it’s actually the Clair bank account is a spending account that’s held at Pathward, it’s a national bank, but Clair’s a technology layer on top of it. But within the spending account of Clair, when consumers select that, that’s how we then get repaid is because they receive the paycheck there.

The differentiation is massive. That allows us to go down market, but also target customers that are, I would say, a bit more reluctant to having to do any payroll work. Payroll is a tricky job and especially if you’re at a larger enterprise because you have multiple states, you have multiple type of different employees and different requests at that level. So, removing that headache of having to do any sort of reconciliation, even if the setup will take a week or two, is a big, big sales point for the Clair product.

Mark: Do you have partnerships and integrations with HR tech companies? And can you tell me about your program and how that works?

Nico: Of course. We have about 14 different HR tech partners. We cover over 10,000 employers now. Over 50,000 workers in the United States use us actively. That ranges from… We basically have two types. It’s either workforce management systems, so that’s from time and attendance of scheduling, and then we have payroll partners, and then that’s POs and classic payroll providers.

Mark: I have the sense that payroll in general is becoming more complicated, not only in terms of regulation, but also in terms of what employees expect. Do I have that right, and what’s gone on?

Nico: Yes. I think payroll, it’s in its nature complicated. It’s not an easy thing to process. There’s many countries in the world that doesn’t put the burden on the employer to collect taxes and deductions for individual consumers. But the way that tax code is built in the US, especially for W-2 employees, there’s a lot of burden on employers to figure this out on behalf of their employees. There’s a benefit with that so that it’s easier to give benefits to consumers in the US and so you have discounted healthcare, you have benefits like this, which is financial services. But payroll is complex. If you spend time with payroll managers, I mean, I commend them for the work that they do because it is not easy.

Mark: Yeah. I’m wondering with all that you do, and I’m curious about your customer base, are you mostly smaller companies or do you have enterprise companies or can you describe that?

Nico: We’re available and live and growing in 29 different industries. So, that is random examples, public school in Georgia, tarmac workers at airports in Florida, large national quick service restaurant chains with thousands and thousands of employees, large hospitality centers like hotel chains across the country, and then mom and pop shops.

The reason why we can do all of it is because for a vast majority of employers, we haven’t gone ahead and sold to them. What we’ve done is we’ve partnered and enabled workforce management and payroll companies to do it themselves. We have received more and more inbound from larger customers that’s say, “We would like something that helps the payroll process,” because right now it’s too convoluted to have a system that requires their payroll process to do something. But yes, the vast majority of our customers are really through the diversified distribution that we have via workforce management and payroll.

Mark: Does that put you at arm’s length from those folks, or do you still deal with them directly when you need to?

Nico: Yeah. So, on-demand pay, earned wage access is still, I think, relatively speaking in its nascency. I think it’s a few million people that really use it or have access to it, and I think there’s 80 million people in the US that if it was available, they would probably use it in some sort. And so I would say 90% of our market, we don’t really encounter any of the previous players. That’s just because of the sheer size of the market. And that’s also the case for most financial services products. Financial services has never been a winner-take-all market. It’s always been pretty divided. I don’t know how many banks there are in the US, I think it’s in the thousands. Some are state-chartered, some are national-chartered. I don’t think that there’s any restrictions in terms of market size here.

Mark: I wanted to ask you about the economy. It seems unsettled right now. It seems like a lot of people just aren’t quite sure what’s going to happen. How is that impacting both your business but also your business planning?

Nico: I think for our business, we cater to America’s workforce, which in times of, for example, high inflation, which we’ve gone through, which was one level of uncertainty we’ve lived through, I think we’ve seen our product help customers and therefore we’ve seen increased adoption.

One particular example I have of that is gas tanks started putting $80 holds on cards where people had only 50 or $30 to pay for gas so they needed actually to use wage advance tools just to cover the block that these gas stations would put temporarily.

The business cycle then has changed towards, “Hey, inflation is now lower…” I mean, it’s half where it was probably at the beginning of the year, but it’s still 4x higher than where it should be, to some standard. And so I think with the Fed raising rates, I think there’s a lot of, to your point, uncertainty about the market. I don’t think that this has necessarily affected the employment markets yet. That doesn’t mean it’s not going to for the rest of the year. And so I think that level of uncertainty is putting a lot of stress on day-to-day workers.

And so for us at Clair, the really big focus is to build products that will relieve some of that financial stress. The word Clair comes from French, which means clarity and the reason why we called it this way is because we want the product to be built in a way that gives full financial transparency to our customer base.

And so we’re going to keep investing in this. We’re going to keep hearing from our customers what kind of products they want. One of our latest products that we’ve invested in, actually was driven by this level of uncertainty that we’re feeling is the level of stress that people had around finding an ATM. It’s one thing to have free ATM access for an application. Another one is how much clarity you give around it. So, we built an entire ATM map, and what we realized is that our customer base felt most secure and felt less financially stressed having this. So, that’s number one. I think for us internally, we see this as a really big motivator for the whole team to keep working where we’re going, and our investors are also behind us to keep pushing.

Mark: So, my last question is one of the things I picked up on recently reading the news is there seems to be more and more talk about regulations on services like yours. And so why do you think that more jurisdictions are looking and how will it impact Clair?

Nico: It’s a great question. I think it makes sense that states, in particular, are looking at regulating earned wage access. I think the position of most if not all earn wage access providers has been, “This is not a typical form of lending and therefore lending laws don’t apply to us.” This has been a stance by many. The idea is, what is the alternative for consumers? It’s probably payday loans, and so this is a better solution. So, the law should help these providers, not stop them.

But I think what regulators are saying is that, “Yes, that’s potentially true, but we just need to make sure that this doesn’t become excessive.” I think Nevada just enacted a law about a week or two ago that kind of guides how a earned wage access program should be built, which is great because the last thing that a technology company wants is regulatory uncertainty. It’s easier to just know what the rule is and just apply for any licenses that are required.

And so what I think we’re going to see over the next three months is more states taking that stance. I think it’s required. But I am not sure that this is really the number one item on the list of some regulators so it might take more time for some of these rules to be enacted. So, I think in the meantime, the whole industry is a little bit in regulatory uncertainty, but Nevada’s showing that there’s a way to give regulatory guidance, is great for programs like ours.

Mark: Nico, thanks very much. It was really great to meet you. It was great to talk with you, and I hope we can do it again sometime.

Nico: Oh, of course. Thank you so much, Mark.

Mark: My guest today has been Nico Simko, the founder and CEO of Clair. And this has been PeopleTech, the podcast of the HCM Technology Report. We’re a publication of Recruiting Daily. We’re also a part of Evergreen Podcasts. To see all of their programs, visit www.evergreenpodcast.com. And to keep up with HR technology, visit the HCM Technology Report every day. We’re the most trusted source of news in the HR tech industry. Find us at www.hcmtechnologyreport.com. I’m Mark Feffer.

Image: Clair